Amortization

Amortization Schedule

An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time.

https://www.investopedia.com/terms/a/amortization.asp

Why does the monthly payment on the house not change even though we put some money towards the principal of the loan?

e.g. If we put $50,000 towards the principal of the house, it will not change the monthly EMI. Why is that?

Amortization calculations

Understanding Amortization

The term “amortization” refers to two situations. First, amortization is used in the process of paying off debt through regular principal and interest payments over time. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments.

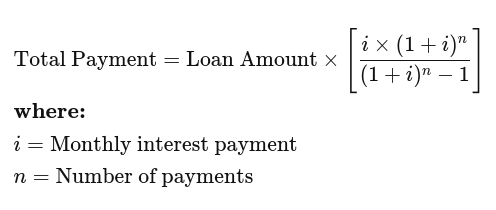

How much is my Total Monthly Payment (total amount that I would have to pay each month) ?

Note that this formula does not take extra fees into consideration.

Monthly interest payment

You need to divide your annual interest rate by 12. For example, if your annual interest rate is 2.625%, then your monthly interest rate will be 2.625% / 12 = 0.21875% or 0.0021875.

Number of payments

The number of years in your loan term by 12. For example, a 30-year loan would have (30 * 12) = 360 payments.

So, Total Monthly Payment will be:

506350 * [ (0.0021875 * 1.0021875^360) / (1.0021875^360 - 1) ]

= 506350 * [ (0.0021875 * 2.196005275) / (20196005275 - 1) ]

= 506350 * [ (0.004803762) / (1.196005275) ]

= 2033.757464613

There will be additional fees (Escrow - which covers taxes and insurance) added to this by the lender.

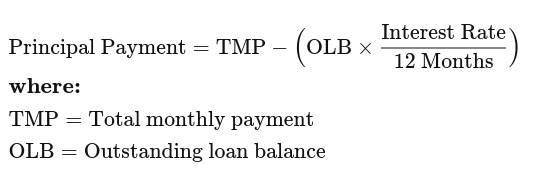

How much principal am I paying per month?

To calculate how much principal you are paying, you need to know the Total Monthly Payment amount first.

Principal paid in the first month

2033.76 - (506350 * (0.02625 / 12))

= 2033.76 - (1107.640625)

= 926.12

Principal paid in the second month

For Outstanding loan balance for the second month, subtract 926.12 from 506325 and use the same formula again.

External References

https://www.fool.com/the-ascent/personal-finance/how-is-loan-amortization-schedule-calculated/